Supply chains could be impacted with the sudden influx of shipping needs.

Over the past 15 months, headlines have revolved around the growth of the economy and how it has impacted our supply chains. Consumer spending has been the greatest factor as generous government assistance has left Americans with extra cash. Even as airline travel, lodging, and entertainment have opened back up, retail sales remain strong. This is especially true as we approach the holiday season. The big question on most logistics professionals’ minds is how long will this 15+ month peak season last? A handful of indexes such as Personal Consumption Expenditures, Savings Rates, the CPI, and TEU bookings may already be trending in a cooling direction.

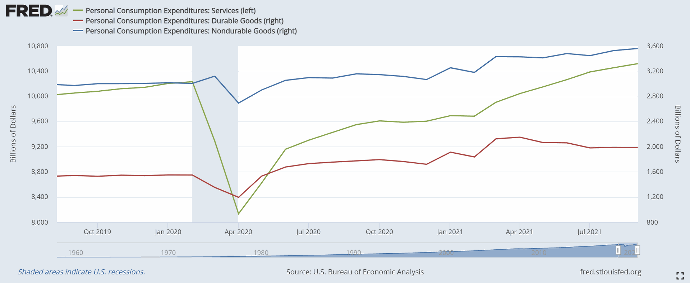

For example, while Service Expenditures have remained above durable and nondurable goods combined throughout the entire pandemic, since Q2 this year PCE Services have really started to pick up steam as COVID fears eased and vaccination counts began to increase. At the same time, durable goods seem to have peaked and are in a downward trend.

Durable goods represent items purchased by consumers that last more than 3 years such as electronics, appliances, and furniture. As we’ve discussed in past episodes, the influx in demand of these goods during the pandemic has kept an enormous amount of pressure on our supply chains.

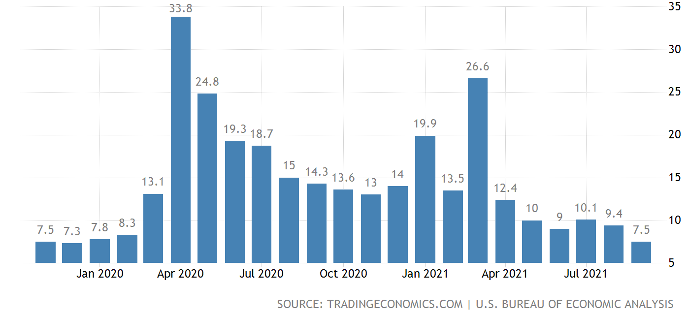

Spending on consumer goods has remained elevated even as consumers began spending money on entertainment, lodging, and travel as the US Personal Savings Rate spent an entire year at or near record levels. However, as of September, the rate has returned to pre-pandemic levels. This is another indicator that without continued government assistance going out to US households regularly, pandemic-like spending cannot sustain.

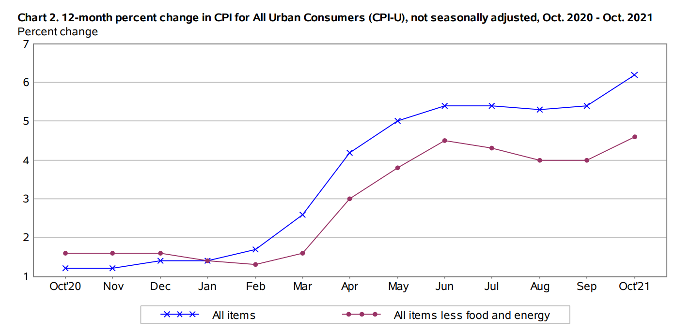

Another factor that may impact consumer spending in the near future is inflation. The Consumer Price Index (a measure of the average change over time in prices paid by consumers) raised 6.2 percent from Oct 2020 to Oct 2021. That’s the largest 12-month increase since the period ending in November of 1990. While some may argue that the consumer can afford to spend a little more right now, a more relevant argument may be “but for how long at our current pace?”

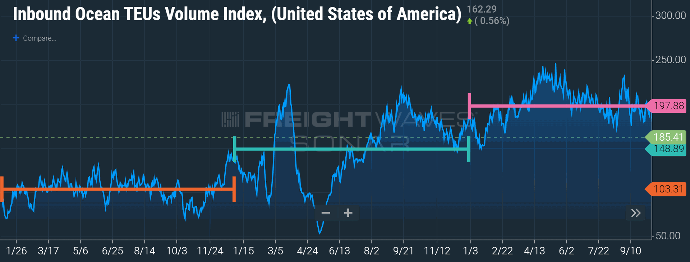

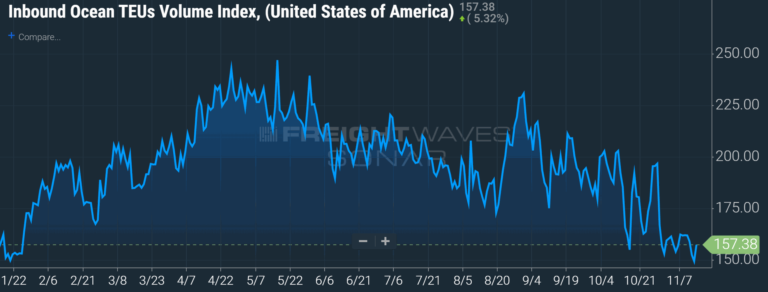

As far as the effect on freight volumes domestically, SONARs Inbound Ocean TEU Volume Index shows us the pace at which inbound TEU bookings have grown over the past three years on average. The YoY jump from 19’ to 20’ and 20’ to 21’ has been remarkable to say the least, and as import volumes remain strong so does the overall demand on all transportation modes.

A different view of the same chart shows bookings trending in a downward progression since their April peak of this year. And while remaining significantly above pre-pandemic levels, the overall bookings trend and some of the other consumer data we discussed, may be a couple of trends to keep an eye on as 2021 ends and next year’s forecasts become relevant.